Are Banking-as-a-Service (BaaS) Platforms The Future of Banking?

BaaS platforms deliver financial institutions‘ data to third-party platforms via APIs. Generally, fintech companies develop digital solutions to banking services thanks to the data provided by BaaS platforms. Digitalization leads to revolutionary changes in the banking field, as in every field. Undoubtedly, one of the most important elements of this technological transformation is BaaS platforms.

Fintech companies that specialize in different technology subjects and sell services or products continue to offer easier and faster solutions to banking methods with BaaS platforms. Today, all financial institutions, including traditional banking, are making significant investments in online and digital banking infrastructures.

At this point, fintech companies developing financial technologies need the data provided by BaaS platforms. Foreseeing that banking dynamics will change rapidly in the future, I can claim that we need to be more interested in BaaS platforms today.

How Do BaaS Platforms Enable Banking Services For Non-Banks?

Developing products or services in the field of finance for platforms that are not banks or financial institutions is possible with BaaS platforms. BaaS platforms offer the data and systems they need to institutions that want to develop financial technologies through the APIs they develop.

Today, understanding the functioning of a bank and determining where solutions are needed may require many years of banking experience. However, thanks to the digital solutions offered by BaaS platforms, those who want to develop entrepreneurial projects in this field can directly access this data and make more accurate applications.

Banking data and financial data on BaaS platforms are delivered to third-party applications via digital tools. Thus, even if an institution is not a bank, it can easily create innovative entrepreneurial projects within the financial universe. While banking is greatly affected by technological developments even today, it is clear that I can foresee this will increase even more in the future.

What Are The Benefits Of BaaS For Fintech Startups?

Fintech companies, which have a significant share among technology companies, offer solutions to financial needs and banking methods. These solutions generally aim to reach everyone by offering solutions to the needs in the financial market.

BaaS platforms are critical for fintech startups to implement this perspective most successfully and not get lost in complex banking infrastructures. Thanks to BaaS platforms, fintech startups can develop scalable financial products or services with low cost, less time and digital flexibility.

Since fintech startups generally aim to sell solutions for customers and banks in the banking ecosystem, they are expected to master the specific needs of this ecosystem. At this point, they can access the data they need through BaaS platforms. By developing BaaS platforms and APIs, they can present the financial infrastructure to be evaluated for commercial projects.

Thanks to the qualified work and products of BaaS platforms, fintech startups have a faster and more cost-effective process. In this way, the technological infrastructure in the banking ecosystem will be strengthened in a more practical way.

How Does Regulation Impact BaaS Providers?

Regulation is a very critical issue for BaaS platforms or BaaS providers, as in other banking areas. BaaS providers must ensure that the data and services they offer comply with legal regulations. For this, BaaS providers should be aware of current regulations and restrictions recommended by governments.

The data required for fintech startups can sometimes reach high costs. I don’t think I need to remind you that data is a very valuable commodity in today’s world. Data privacy regulation can profoundly impact the way some BaaS platforms operate and result in more limited transactions.

For this reason, both those who develop fintech startups and BaaS platforms should follow current legal regulations closely and develop projects within this framework. Since different countries have different banking regulations, fintech startups cannot be expected to be independent of the existing banking regulations of the market or country in which they are located.

Although decentralized finance solutions such as blockchain technologies will eliminate such problems in the near future, it seems that this liberal transformation will not last long.

What Role Do APIs Play In BaaS Offerings?

APIs are one of the concepts that institutions and people working in the software field are familiar with. Thanks to APIs, which stand for Application Programming Interfaces, different software languages can be managed from a common panel, and this allows software to be developed as a solution for different needs.

APIs are also one of the basic materials for BaaS platforms. BaaS platforms maintain communication between different platforms through APIs. In this way, fintech companies can test the solutions they have developed in different financial ecosystems through these APIs.

The way to test whether the products or services offered by fintech startups function in the real financial ecosystem is to benefit from the APIs offered by BaaS platforms. For example, let’s say a fintech startup aims to provide solutions to mobile banking problems.

In such a case, they can test the product they have developed and check the developments thanks to the APIs offered by BaaS platforms. API is a software concept that institutions and people interested in the Fintech field should definitely be familiar with. It acts as a bridge between finance and software that BaaS platforms benefit from.

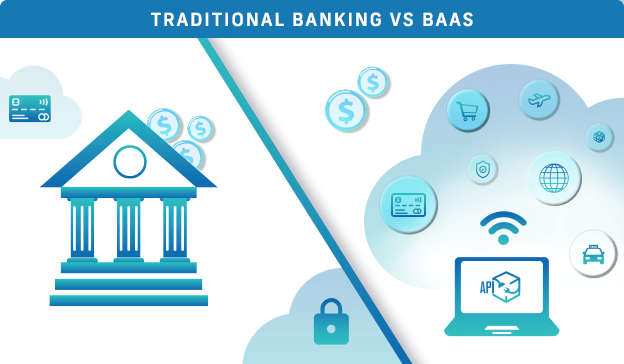

Can Traditional Banks Compete With BaaS Providers?

BaaS providers are fundamentally not competitors to traditional banks in the market. However, the digital banking products or services they offer may be more attractive than those offered by traditional banks. This may lead to an increase in market shares.

I know that today different traditional banks operating in different markets of the world are preparing for digital transformation, but I can state that BaaS providers will compete more with traditional banks in the near future. Today, we also know that some traditional bankers are establishing their own BaaS platforms to accelerate their digital transformation.

This is essential for traditional banks to respond and adapt to new digital needs that arise day by day. However, it will still take a long time for the majority of traditional banks to complete this adaptation. For now, it is useful to take a look at the products or services of BaaS platforms regarding fintech solutions.

See you in the next post,

Anil UZUN