What Are The Financial Sustainability Goals Of Banks?

Fundamental features in the field of finance are among the main factors that show economic development. Sustainability can be achieved through financially secure and qualified transactions. There can be many different institutions and organizations that make up finance and economy. Banks can be considered as institutions that are right in the middle of economy and finance. All economic affairs are carried out entirely through banks. The level of preference of banks has reached its peak because of the fact that banks can offer very safe transactions with the developing technology and that they can continue their transactions in a qualified manner. The systems and opportunities created by the banks continue to evolve. With the digitalization of banks, facilities such as mobile banking and internet banking have become more functional instead of institutions such as bank branches. You do not need to go to a bank branch or deal with a lot of paperwork in the use of financing. Transactions can usually be completed quickly via mobile applications.

Banks have a very important place as they are the basis of today’s financial transactions. The quality of transactions and the financial sustainability of banks is an important issue. Banks serve their customers using different financial instruments and methods. For this reason, the sustainability of this process is as important as the effective participation of banks in financial markets. While financial institutions provide loans on the one hand, they also have to make profits with different investment instruments. Along with the services offered, banks need to develop their own financial systems and investment portfolios. Today, banks are not just lending institutions. Banks should be seen as institutions where many investments are directed and markets are shaped. We can see that banks are involved in many money markets. By evaluating the different investments of their customers, banks take an active part in money markets with an intense capital.

Banks And Financial Sustainability

We can understand it as the continuation of the system for long periods in the process of executing the transactions. A financial institution should generate significant returns without any loss through the services it provides and the transactions it makes. An investment institution that provides services to its customers and provides loans may lose its financial quality in a short time when it does not make a profit. Today, banks are active in quite different finance areas. Banks are particularly active in the field of investment and generate significant financial returns. There are quite a few different processes and instruments that will contribute to financial sustainability. Since the service portfolio of banks is increasing day by day, we can say that they have good financial characteristics. In order for banks to maintain this situation, the government and investors need to create an environment of trust.

In order for banks to maintain their financial sustainability features, especially governments need to make good regulations. Thanks to the processes that regulate financial transactions and investments well, the services offered by the banks will be returned. For conveniences such as credit services and advances offered by banks, users’ payments must be regular. It is almost impossible to ensure financial sustainability because it is not recycled by users to banks. Regulations regarding the provision of financial services need to be made by states. In addition, the basic strategies and targets followed by banks in financial sustainability are also very important. Financial sustainability will increase as banks make progress in development and quality of services. He usually tries to improve this quality by using different tools. With the involvement of banks in the field of investment, it has become easier to ensure financial sustainability. Today, banks have become an effective power by taking part in almost every money market. Especially banks that evaluate their investors’ capitals in different markets gain significant returns. It can be said that some banks have become an important power factor on the money markets. Providing this condition may not be easy for every bank. The basic qualifications and service standards of banks are among the basic criteria to ensure these conditions.

Financial Sustainability And Investment Markets

When a financial institution is not involved in investment markets, it is very difficult to ensure financial sustainability. banks make significant investments in areas such as foreign exchange markets and commodities, especially in stock markets. In order for these investments to be made by banks, investors must deliver their investments with confidence. In this case, the environment of trust created by the bank is also very important. It is very important for the bank to achieve significant success in the field of investment and to be able to direct its investors with different tools such as mutual funds. Investors can come to the bank with more capital when they get significant returns when they work with the bank. Banks need to make new developments and engage in different studies in the field of investment. When a bank becomes an important power in the field of investment, it will have completed an important factor in terms of financial sustainability. In terms of financial sustainability, we can see that many banks set investment-related targets today.

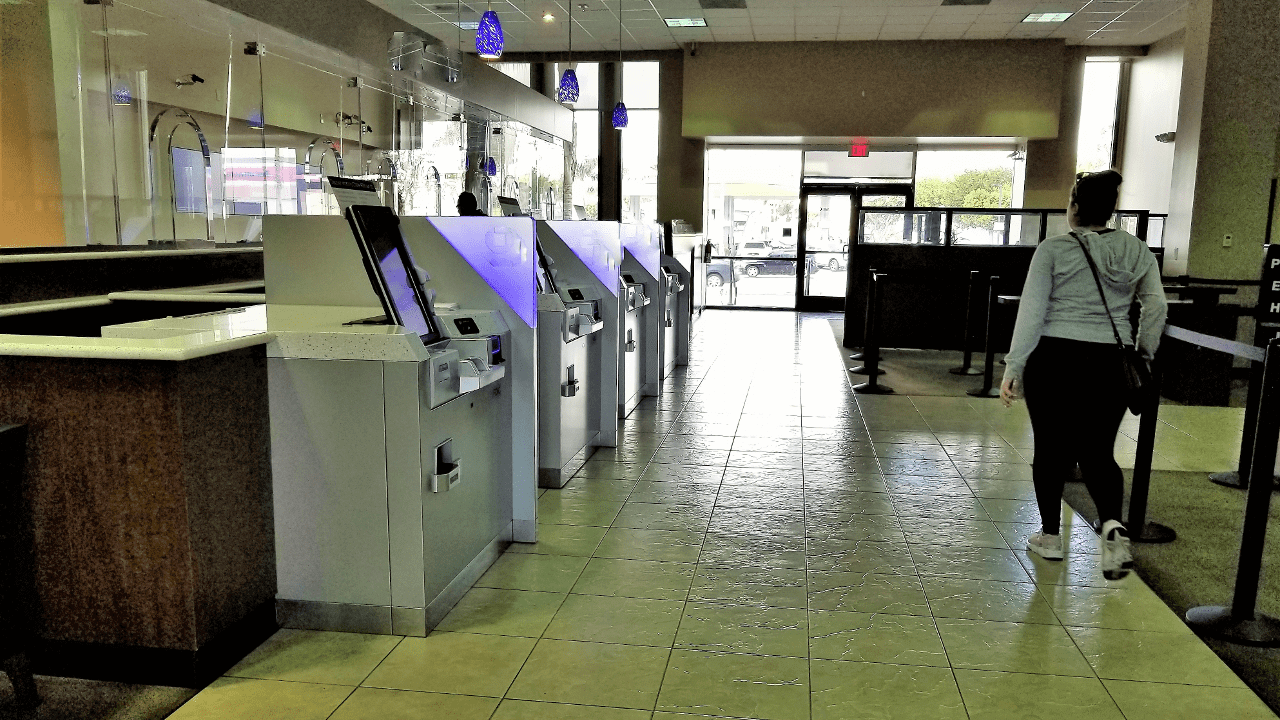

Banks’ development of digitalization is among their important goals. It is very important that users can make their investments in the digital environment and that the bank can offer new services in directing investments. Banks’ use of different software and digital applications can provide significant returns. For a user, it is among the most requested features that bank applications are useful and make investments easy. In this respect, it is very important for banks to develop digitalization in the field of investment and to allow them to invest with different investment instruments. Although banks have turned into an increasingly digital structure today, it would be correct to turn more towards digitalization in order to maintain financial sustainability.

New Financial Services

We can see that many transactions are carried out. With the applications developed thanks to the banks, all transactions can be made without going to any institution or branch. Bank applications have become one of today’s payment points. All payment transactions can be made by bank applications. Banking applications are used effectively for insurance transactions, vehicle or housing related transactions. At the point of ensuring financial sustainability, it is very important for a bank to develop its services and reveal new areas. Many areas such as sales, corporate payments, investments, insurance, health and education expenditures are included in banks today. When a bank develops these transactions and processes, it will make significant gains. Today, every financial institution has set it as a goal to develop new services.

See you in the next post,

Anil UZUN