Which Criteria Are Important For Comparing The Services Provided By Banks?

Financial and investment transactions can be carried out quite easily. It is obvious that with the digitalized world, innovations have emerged in every field and the profound effects of changes that make human life easier. We live in an environment where significant changes are seen in every field, as it takes place in every field and has become an important necessity. People’s behavior and habits are undergoing rapid change. Along with the results of the change, institutions and companies also have to renew themselves. Especially every company that wants to exist in the future has to keep up with these changes in the digitalized world. Unfortunately, businesses and companies will not be able to take part in their sector in the near future. We can say that innovation is an important requirement in every field and sector.

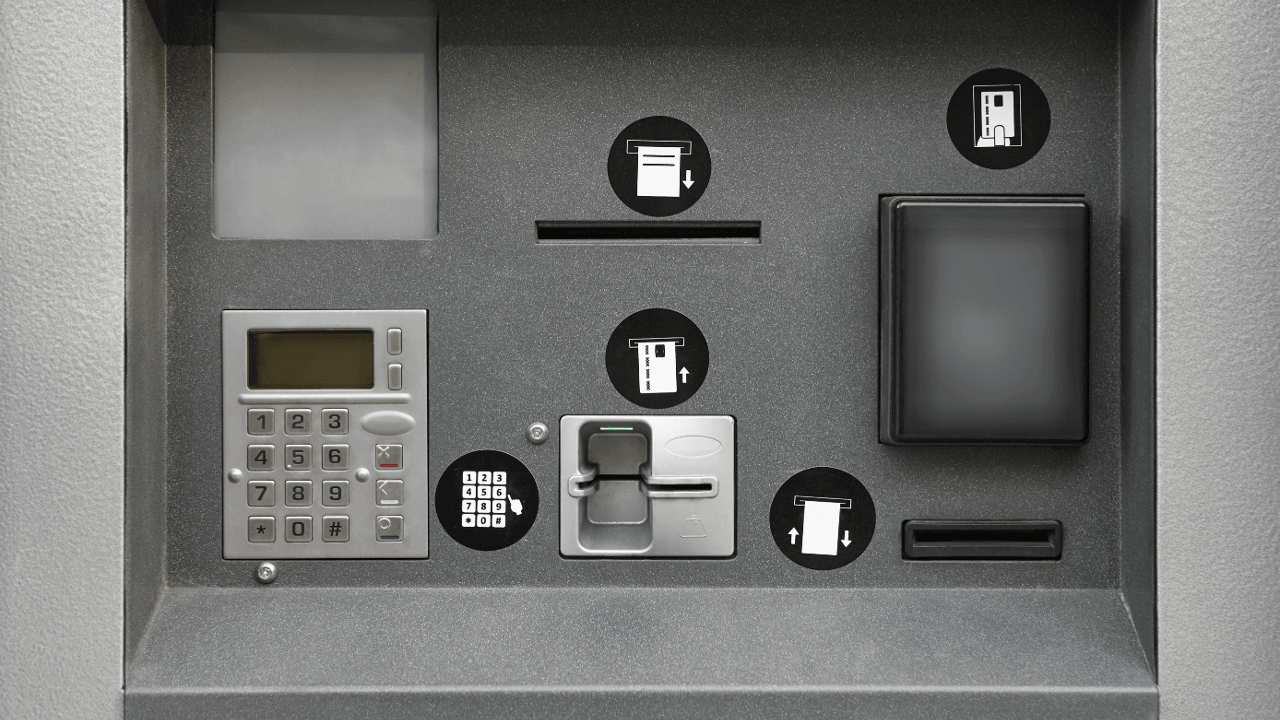

Financial institutions are at the forefront of the areas where the most destructive effects of technology and digital life are seen. Banks have made significant progress in terms of technological transformation. All services are performed digitally. We can see a significant transformation occur as banking services are asked digitally and almost no bank branch is needed. In the financial world, people now want to perform all their transactions only through applications on their smartphones. Any service in the banking sector is not adopted by people when it progresses in a way that requires intensive paperwork or conditions. However, when a service fulfills people’s financial transactions in a qualitative way, that field becomes more and more open to development. Due to the digitalized financial structure, it has come to a situation where there is almost no need for different financial institutions. Due to this situation, banking services can generally be carried out with standard and same planning.

Banks And Their Basic Services

It is among the basic institutions of the economy. In today’s world, it has become very difficult to carry out any financial transactions or even shopping without banks. When you need anything right now, all you have to do is have a credit card. With a credit card, you can have any product that can sustain your life, or you can make different transactions according to your economic structure. Basic services offered by banks, such as credit cards, allow people to move easily in life and be actively involved in the economic structure. Credit cards are one of the products offered by banks. banks don’t just offer different products. It deals with people’s accounts, investments, insurance or payments. From this point of view, we can talk about banks wherever money enters in human life. All of these services can be easily performed by services such as internet banking today.

One of the most important services is loan and financing options. When individuals or institutions need a loan in any way, their only stopping point is banks. Thanks to the loan options, cash can be allocated for quite different amounts and used easily. In today’s conditions, many needs can be met with the loan options offered with appropriate interest rates and terms. Different loan options can be offered by banks for individual needs or for products such as vehicles and housing. Loans, which are among the most important banking services, have recently been among the most used financial services by everyone and every institution. Especially for now, many new ventures and investments are provided with loans. We can say that loans provided by banks are the basis of many emerging companies and services. Although many similar services are offered by banks, it is difficult to say that every institution carries out its transactions in the same way. There are significant differences in the delivery of services between financial institutions. When choosing a bank, people and institutions prefer the banks that will provide the best service. The basic policy of banks while providing services is one of the main criteria in choosing a bank.

Services And Convenience Provided By Banks

There are numerous financial institutions. While people prefer banks for the financial services they need, convenience is among the most important criteria. In particular, people stay away from institutions that put forward difficult conditions regarding the service they will receive or that want the services to be provided with documents instead of digital media. In today’s modern world, financial institutions that people can reach and communicate with at all times are in a more preferable position. First of all, the financial institution’s ability to make transactions and offer its services quickly without bothering the user comes first.

Since the emergence of digital environments, the most preferred financial services by people have been services such as mobile banking or internet banking. Thanks to these facilities, all applications and financial services are in an accessible location. At the point of getting these services, it is more attractive because there is no waiting in line or dealing with a staff. In today’s conditions, the level of preference of a bank that has not developed such banking options will be low. In particular, a bank should establish a system that will cover all services within its mobile banking options. In this way, a person will continue all his transactions by the same financial institution and the bank will continue to develop. Creating some shortcuts is among the works that can be done in order to make the difficult processes easier in financial institutions in order to bring banks to the fore. Developing user-friendly software and applications at the point of providing banking services can also be among the works that can be done.

Banking Services And Fees

Today, hundreds of services are offered by financial institutions. Significant fees and commissions are also charged for services. Even if the services offered by banks are easy and qualified, if they have high fees, the level of preference will be very low. For this reason, the basic fees and commission rates of a banking service are among the most important criteria. If it is desired to be preferred more by businesses, a good study on interest and fees is also a must. For this, determining commission rates that are close or cheaper than other banks can increase the level of preference of a bank. With the evaluation of the fee within the scope of all banking services, the level of preference will increase considerably.

See you in the next post,

Anil UZUN