How Can APIs Enhance Customer Experience In Digital Banking?

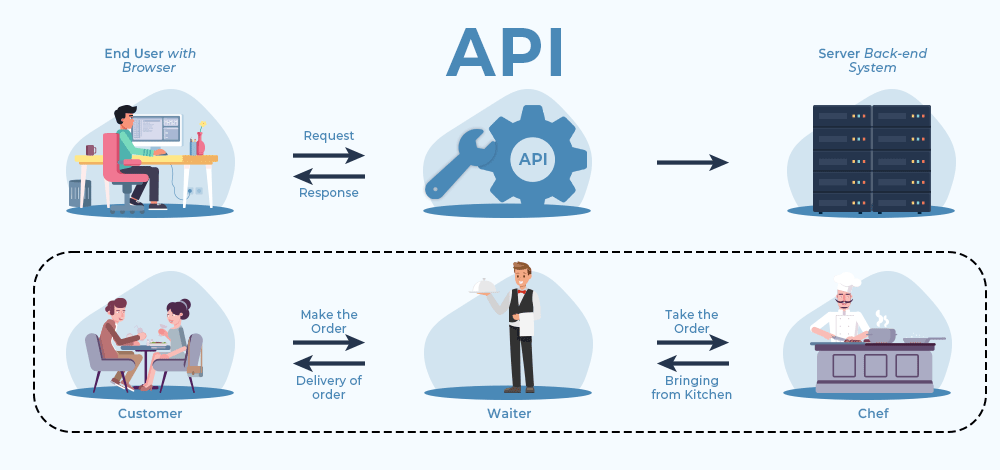

API, which is well known by software developers and stands for Application Programming Interface, is an interface that enables communication between applications. Just as they are used in different areas, they are frequently used when developing digital solutions in banking.

Fintech companies can retrieve data through APIs while creating different software systems and applications. In this way, financial platforms can share consumers’ data with third-party applications. When an API that provides payment systems in banks is used through an application, payment is also possible in that application.

APIs can be developed and faster and customer-oriented solutions can be created. APIs directly improve the customer experience by increasing the service options that customers access. Customers receiving banking services can solve their problems and needs in a shorter time by using digital solutions offered through APIs.

Although APIs are a technical concept in the field of software, they are technological units frequently used in the construction of digital banking. Thanks to these interfaces, cooperation between banks and third-party applications takes place. This results in a better banking experience for customers.

What Are Banking APIs, And How Do They Enable Enhanced Customer Experiences?

APIs used in digital banking provide the data that both banks and third-party developers, fintech startups and companies, need to develop digital solutions. Thanks to this data, problems and needs can be determined more accurately.

Banks and financial institutions use banking APIs to analyze customers’ data accurately and develop direct solutions to their needs. Fintech startups and companies can obtain banking practices through APIs. In this way, they improve the banking ecosystem by developing more accurate products and services.

Banking APIs are one of the most frequently used technological units of the digital banking era. I can foresee that in the near future, APIs and software units will be used more efficiently for the complete digitalization of banking and will become a more popular banking term, even though it is a technical concept related to software.

How Do Open Banking APIs Facilitate Seamless Financial Services Integration?

Some banking APIs are open and accessible by institutions so that other software developers can benefit from them. These types of APIs are called Open Banking APIs.

The services offered by financial institutions are developed through APIs. Because data sharing between different financial institutions is provided through APIs in the software field. This allows customers to receive different banking services through a single application.

For example, payment by QR code, one of the popular banking trends of recent years, is a type of digital solution and innovation. Those who want to add QR code payment methods among the payment methods of their platform can integrate it into their applications and infrastructure via APIs. Open Banking APIs are units that offer solutions that can be used by everyone.

What Are The Most Common Use Cases For Banking APIs In Customer-Focused Applications?

Fintech companies, startups and financial institutions deliver many different services and products to their customers using banking APIs. Common banking applications can be listed among the most common areas of use. For example, common banking operations such as balance inquiry, bill payment and checking and updating account information are combined in a single application thanks to banking APIs.

Different banks compete in the banking market to offer the richest options in their mobile applications and services. APIs are used by relevant departments of banks to deliver customer-oriented applications and deliver more products and services.

In order for you to pay a bill via a bank’s mobile application, the institution to which the bill is presented must provide an API with the bank. Institutions that share their data with banks as Open Banking API can receive their payments through the platforms of these financial institutions. If there were no APIs, we would have to use different applications and units for each transaction, but thanks to Open Banking APIs, many products and services can be combined on a single platform.

How Can Banks Ensure Data Security And Privacy With Open APIs?

Although Open Banking APIs enable data flow between applications and offer many options in one application, they also bring with them some privacy and confidentiality concerns.

To avoid possible data privacy concerns, banks protect their open banking APIs with strong encryption techniques. It also maximizes security measures by diversifying authentication mechanisms for customers.

For fintech startups and companies, cyber security and data privacy are important issues that need to be allocated resources, energy and time. In order to develop customer-oriented banking applications, data confidentiality and privacy principles in APIs should not be forgotten.

Are Third-Party Developers Transforming Digital Banking Through APIs?

Third-party developers work to develop direct solutions to customers’ new problems using Open Banking APIs. They develop digital solutions so that everyone can receive similar banking services in accordance with the principle of financial inclusion. Today, many large companies and banks offer open banking APIs, ensuring that market developments have a global perspective and are spread collectively.

In the highly competitive banking ecosystem, while almost all popular financial platforms offer common and similar services, those who use these APIs in startup and enterprise projects and offer innovative solutions can be more profitable.

For example, a payment that can be made through a mobile application may not be made in the mobile application of another financial platform. For this reason, that financial platform must provide this service to its customers via APIs.

Today, in the age of modern banking and digital banking, there is high competition in all markets. In highly competitive markets, institutions that directly respond to customers’ banking needs will be more profitable in the short term.

Third-party developers, who use the data they receive through APIs to solve problems and develop customer-oriented applications and services, also diversify the accessibility and solutions of digital banking. For this reason, fintech startups and companies need to make proper use of APIs.

See you in the next post,

Anil UZUN